US Tax Season 2025: A CPA Firm Owner’s Guide to Preparing Your Team

Tax season has become synonymous with stress for many accounting firm owners and their teams. The long hours, tight deadlines, and constant client demands can push even the most seasoned professionals to their limits.

While the pressure may feel inevitable, much of the stress stems from inadequate preparation and efficient systems. Without a clear plan, the chaos of tax season can overwhelm your team, increase the risk of errors, and jeopardize client relationships.

You don’t have to let tax season feel overwhelming. With the right preparation strategies, you can turn it into a streamlined, manageable process. This guide provides a step-by-step approach to how to prepare for tax season 2025. By taking proactive steps, you can optimize workflows, boost team productivity, and deliver exceptional results for your clients—all while easing the workload for you and your staff.

Review Last Tax Season’s Performance

The best way to start preparing for the upcoming tax season is to assess how your firm performed last financial year. Reflect on the workloads, tools, and team dynamics that either facilitated success or caused bottlenecks.

- Were deadlines consistently met, or did certain periods overwhelm the team?

- Did clients submit their documents on time?

- Did your team members have problems using the tax software?

- How effective was it?

In addition to your analysis, seek feedback from your team. Meet to discuss challenges and successes or use an anonymous survey to encourage honest input. Consider asking questions like:

- Was the workload evenly distributed?

- Did team members feel adequately supported?

- Were there specific tasks that consumed unnecessary time?

Once you’ve identified areas for improvement, develop an action plan. For instance, if clients sent their tax documents late last year, let them know when the tax season is in 2025. If disorganized client submissions caused delays, you might prioritize implementing better document collection systems.

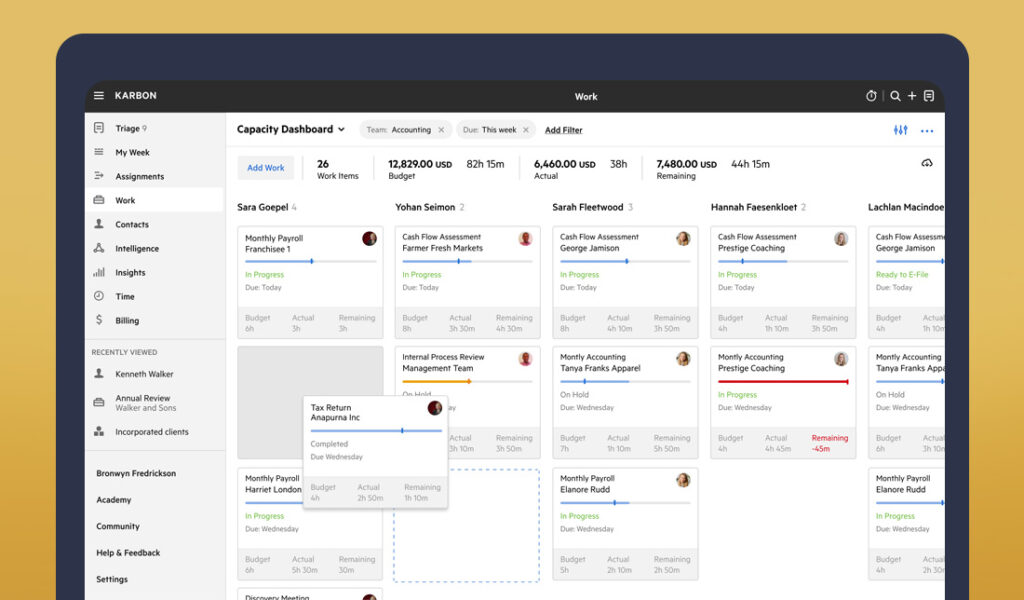

If heavy workloads were unevenly distributed, creating stress, consider using accounting task management software such as Karbon to see which team members were overloaded and which ones could take on more tasks.

Organize Client Financial Documents Early

Getting clients to hand over financial documents is one of the few things you cannot control, making it one of the most frustrating challenges for accountants during tax season. To avoid these delays, proactively communicate with your clients about the documents they must provide:

Personal Information

- Social Security numbers for all individuals on the return.

- Address and updated contact details.

Income Documentation

- W-2 forms for wages.

- 1099 forms for freelance, rental, or other income (NEC, DIV, INT, etc.).

- Investment statements showing dividends or gains/losses.

- Documents for business income, including Schedule K-1s.

Deduction Information

- Receipts for medical and dental expenses not reimbursed.

- Property tax statements and mortgage interest (Form 1098).

- Charitable donation receipts (cash and non-cash).

- Records of significant work-related expenses.

Credits Eligibility

- 1098-T for education expenses.

- Proof of child or dependent care expenses, including provider information.

- Adoption costs or energy-efficient home improvement receipts.

Other Essentials

- Last year’s tax return (if new client).

- Estimated tax payments made during the year.

Improve document collection by using a secure client portal where clients can easily upload their files. Tools like SmartVault or Canopy simplify the process while safeguarding sensitive information. With an organized system, your team can quickly access and review client documents without losing time digging through emails or physical records.

Establish Clear Client Communication

Without a clear communication plan, deadlines can be missed, and important details may be overlooked. By segmenting your clients into categories based on their complexity and deadlines. For instance:

- Early filers

- Corporate clients with complex returns

- Individuals likely to file extensions

For each segment, create a communication schedule outlining critical dates for document submission, meeting reminders, and filing deadlines. Use tools like email automation software or customer relationship management (CRM) platforms to send timely updates. Personalize your messages as much as possible to ensure clients feel valued.

Encourage clients to reach out with questions or concerns and establish clear guidelines for how they can contact you or your team. Setting boundaries around response times can help manage expectations while ensuring clients receive the support they need.

Leverage Tax Software for Accuracy and Efficiency

The right tax software can make your firm significantly more efficient. In 2025, it’s essential to use software that supports e-filing, integrates with your existing tools, and stays updated on the latest tax regulations. Popular options include Drake Tax, TaxSlayer Pro, and ProConnect Tax Online. Each platform offers unique features, so choose one that aligns with your firm’s needs.

Before tax season begins, ensure your team is thoroughly trained on the software. Schedule practice sessions and address any questions or challenges they encounter. This preparation minimizes errors and boosts confidence, allowing your team to work more efficiently under pressure.

Stay Updated on Tax Law Changes

Tax laws evolve constantly, and staying informed is critical for maintaining compliance and delivering accurate returns. For the 2025 tax season, pay close attention to the changes in federal and state tax brackets, updates to deductions and credits (such as Child Tax Credit), and any new regulations affecting small businesses.

Stay informed by subscribing to Internal Revenue Service (IRS) updates and joining professional organizations like the American Institute of CPAs (AICPA). Attend webinars or seminars on tax law changes to keep your knowledge current. Designate a team member to monitor updates and share key insights during meetings, ensuring everyone stays current.

Bring in Offshore Accountants

If your team is stretched thin, consider hiring offshore accountants to handle routine tasks such as data entry, bookkeeping, or initial tax prep. Offshore accountants can be a cost-effective solution for increasing capacity without overloading your in-house team.

To build a successful partnership, work with a trusted offshore accounting provider like TOA Global, which has expertise in U.S. tax laws. Offshore CPAs can lighten your onshore team’s workload, enabling them to concentrate on high-value tasks such as client advisory services.

Implement Time Management Practices

Time management is essential for surviving tax season. Encourage your team to adopt strategies like time blocking, where specific hours are allocated to high-priority tasks, or the Pomodoro Technique, which uses focused work intervals followed by short breaks.

Delegation is another important strategy—assign repetitive tasks to junior staff or offshore accountants so senior team members can allocate energy to more complex work.

As a leader, set the tone by respecting boundaries and modeling healthy work habits. Avoid overloading your team with unrealistic deadlines and encourage regular breaks to maintain productivity and morale.

Prioritize Team Well-Being

Tax season is notorious for burning out accountants, so prioritizing your team’s well-being is vital to improving productivity and keeping the spirit alive. Provide access to mental health resources such as counseling, gym, and workout sessions, or even dedicate breakout spaces.

In addition, recognize your team’s hard work through small gestures like catered lunches or thank-you notes. A happy team is productive, and their well-being should be prioritized.

Conduct a Pre-Tax Season Mock Run

Run a mock tax season before the official tax season 2025 start date to test your workflows and systems. Simulate real scenarios like managing a flood of returns or resolving client concerns. This practice helps you pinpoint bottlenecks, fine-tune processes, and ensure your team is ready for the demanding months ahead.

Focus on Client Retention

Tax season offers a valuable chance to deepen client relationships. Go beyond preparing returns by providing services like financial planning or business strategy consultations. Demonstrating your commitment to their long-term success fosters loyalty and distinguishes you from competitors.

Key Tax Dates to Note for 2025

So, when does the tax season 2025 start? What are some key dates to keep in mind? To stay on top of your deadlines, familiarize yourself and the team with the key tax dates for the 2025 filing season. Here’s a quick reference:

| Tax Dates | Details |

|---|---|

| January 15, 2025 | Tax season 2025 start date. |

| January 15, 2025 | Estimated quarterly tax payments due for Q4 of 2024. |

| January 31, 2025 | Deadline for employers to send W-2s to employees and file 1099 forms with the Internal Revenue Service (IRS). |

| March 15, 2025 | Due date for S-corporations and partnerships to file their 2024 business tax return. |

| April 15, 2025 | Tax Day – the deadline for filing individual tax returns (form 1040) for most states or requesting an extension. |

| April 15, 2025 | Deadline for calendar-year C corporations to file 2024 tax returns (form 1120) or request a six-month extension. |

| April 15, 2025 | Q1 estimated tax payments for the 2025 tax year are due. |

| June 15, 2025 | Estimated quarterly tax payments due for Q2 of 2025. |

| September 15, 2025 | Final deadline for partnerships and S corporations on an extension to file tax returns. |

| September 15, 2025 | Q3 estimated tax payments for the 2025 tax year are due. |

| October 15, 2025 | Final deadline for individual taxpayers on an extension to file tax returns. |

| October 15, 2025 | The final deadline for C corporations is to file 2024 tax returns if granted an extension. |

| December 31, 2025 | Today is the last day to take actions impacting your 2025 tax returns, including making charitable contributions, selling investments, or finalizing other tax-related decisions. |

Additional Notes

- State-Specific Deadlines – Check with your respective state tax authority; these dates can vary.

- Payroll Tax Deadlines – Employers should remain aware of periodic payroll tax deposit deadlines, which depend on their deposit schedule (semi-weekly or monthly).

Mark these dates on your calendar and share them with your team and clients to ensure everyone stays on track.

Face the 2025 US Tax Season with Confidence with TopFirm on the Assist

Preparing for tax season is challenging and demands a proactive, organized approach. Even with the best plans, unexpected issues can arise. However, by implementing the abovementioned strategies, you can establish an efficient process that benefits your clients and your firm. These steps position you to confidently approach tax season and achieve successful outcomes.

You don’t have to face tax season alone. At TopFirm, our experienced coaches are here to support you—whether you want to enhance your leadership skills, gain more time freedom, or beef up your team with offshore accountants. Schedule a Free Growth Session with us, and let’s explore how we can work together to achieve your goals!

About the Author:

Alec Viray

Content Writer

Alec is a versatile content writer with years of experience in the accounting and financial services sector. His Psychology degree and strong content marketing, SEO, and blog writing background allow him to create engaging content that resonates with his target audience. Outside of work, Alec enjoys watching movies, TV shows, and anime and playing strategy-based RPG video games.