What Do Accountants Do? The Evolving Role of CPAs in Modern Accounting

When we take a look at an accountant’s job description today, it’s incredible to see how much has changed. Gone are the days when the accountant’s primary focus is number crunching, working behind the scenes.

Today, accountants have evolved into tech-savvy financial curators and strategic advisors. Understanding this evolution can be a game-changer for accounting firm owners, especially those who haven’t fully maximized their teams’ potential.

As a CPA coaching business, we see this transformation firsthand in firms of all sizes. Accounting professionals today go beyond balancing sheets and filing tax returns—they interpret financial information, advise on strategic choices, and navigate regulatory changes.

To make the most of this expertise, it’s essential to understand what modern accountants do, how technology is reshaping the field, and why certified public accountants (CPAs) now need a blend of technical, strategic, and interpersonal skills. This guide will explore the evolving responsibilities shaping today’s accounting landscape.

What Does an Accountant’s Role Look Like Today?

The best accountants are not just number-crunchers; they’re financial storytellers.”

-Jessica Turner

Historically, accountancy professionals were considered experts in ledger balancing and tax preparation. But today, data flows faster and more freely than ever, and clients and businesses need CPAs to help make sense of it. Accountants today play a critical role in managing financial data. They gather, organize, and interpret financial data that drives vital business insights and decisions.

Instead of recording financial transactions, accountants use technology to consolidate financial information into actionable reports, analyses, and forecasts. AI is automating more of the data processing, but it’s the accountant who transcribes these findings, contextualizes them into information that non-accountant clients can understand, and advises on strategy.

By synthesizing insights, accountants help business owners identify patterns, anticipate risks, and spot growth opportunities. Accounting professionals are no longer just tracking financial statements; they’re trusted partners, guiding clients to stay competitive.

The Rise of Modern Accountants

So, what actually pushed this change?

If there’s one driving force behind this transformation, it’s technology. From cloud accounting to AI and automation, advancements are changing how CPAs work. For firm owners who may still rely on more traditional methods, here’s what these tech solutions can mean for your team and your firm’s growth.

1. Cloud-Based Accounting

The shift to the cloud has been monumental. CPAs are now freed from the shackles of handling physical financial documents and manual data entry.

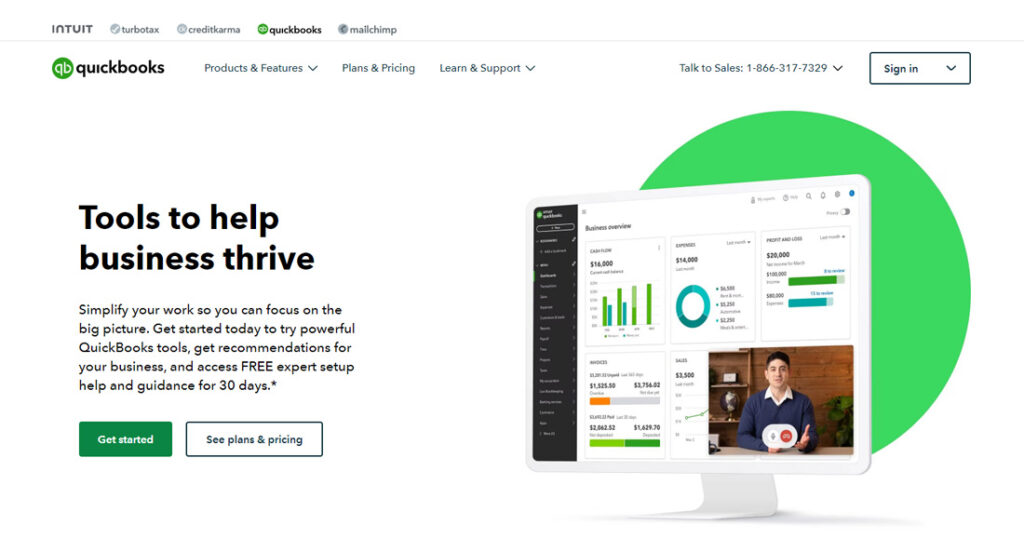

Cloud platforms like QuickBooks and Xero enable real-time access to financial statements and streamline workflows. Accountants can collaborate seamlessly with clients and teams, allowing them to focus more on providing insights rather than compiling numbers. Other cloud platform options are Karbon, Jetpack Workflow, and FYI.

2. AI and Automation

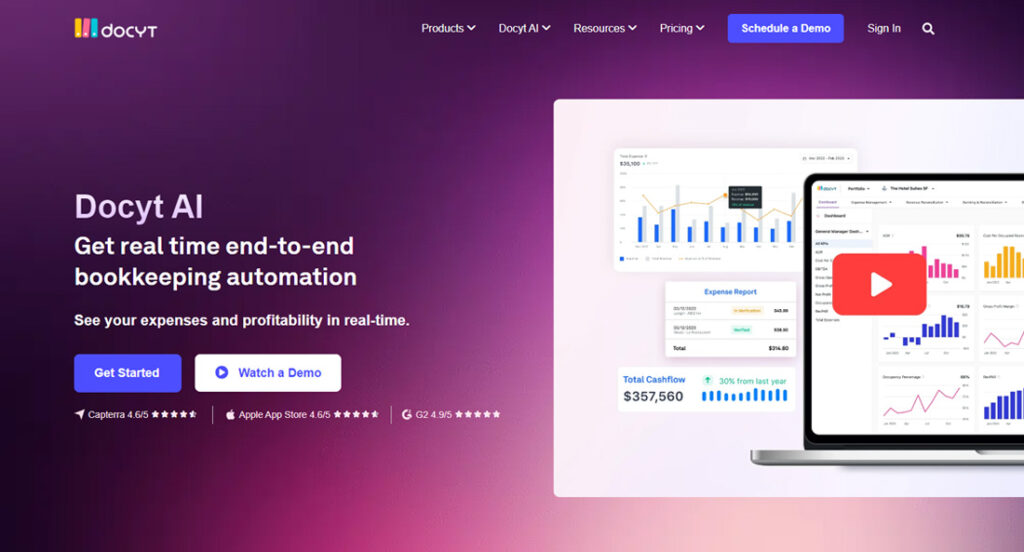

AI and automation tools such as Docyt and Vic.AI have made tasks like data entry, reconciliations, and report generation faster and more accurate than ever. This shift means accountants can spend less time on routine tasks and more on analyzing financial data and advising clients.

Imagine if, instead of spending hours each week on data verification, your team could rely on AI to handle repetitive tasks while they focus on forecasting financial trends, strategy, and advisory work that drives real value. By supporting this shift, firm owners enable their teams to engage in high-impact activities that contribute directly to the firm’s growth.

3. Analytics and Insights

With the uprising of all these technologies, accounting now goes beyond managing past financial records; it also prepares clients for the future. Data analytics lets accountants extract valuable insights, anticipate trends, manage risks, and form strategies. Investing in these tools and skills enables your team to offer forward-thinking guidance, putting your firm ahead of those still doing traditional accounting.

The Evolution of Accountants

As technology transforms accounting, accountants need to evolve their skill sets. Today’s CPAs must be tech-savvy, skilled in data analysis, and strategic thinkers. But that’s just part of it—they also need strong communication, ethical leadership, and a commitment to continuous learning.

Tech Savviness

Technology proficiency is now essential for accountants, especially with 88% of SMEs emphasizing its importance. Accountants need to leverage advanced accounting software effectively and stay vigilant about cybersecurity risks, ensuring they not only use technology but also secure it to protect clients.

This shift calls for firm owners to cultivate a learning culture where teams can keep advancing their skills. Technology training should be offered as part of onboarding and ongoing education. When your team feels confident with tech, they’ll work more efficiently and deliver better results.

Strategic Advisory Mindset

As we’ve already established, modern accountants are expected to serve as advisors, not just record keepers. They must think strategically, helping clients and business leaders make informed decisions and identify growth opportunities.

Encourage your team to engage fully in client conversations, ask insightful questions, and understand each client’s industry and goals. When CPAs look beyond the numbers and approach clients’ businesses with genuine interest, they deliver insights that drive transformative results.

Soft Skills and Leadership

Accounting firms are in the business of trust. Nowadays, CPAs need exceptional communication and relationship-building skills to cultivate trust with clients and colleagues. Whether they’re explaining financial statements, delivering financial insights to clients, or mentoring junior team members, these skills are essential for a cohesive, client-centered firm culture.

Ethical leadership has become more crucial than ever. As data privacy and security concerns rise, accountants are considered stewards of integrity. You protect your client’s sensitive financial documents and reputation by fostering a solid ethical framework within your firm.

Core Modern-Day Accountant Responsibilities

So, with all that being said, what do today’s accountants do daily? Here are the key responsibilities accountants undertake to deliver value to clients and organizations.

1. Financial Reporting and Analysis

Accountants are still in charge of preparing financial statements, but with AI handling more of the heavy lifting, CPAs now focus on interpreting these financial reports. They transform raw financial data into actionable insights, guiding clients and firms toward informed decisions. This analytical approach creates a roadmap for business growth, spotlighting strengths and flagging potential risks.

2. Tax Planning and Compliance

Tax laws change frequently, and clients count on tax accountants to keep them compliant while minimizing liabilities. Accountants must not only interpret the current tax code accurately but also identify tax-saving opportunities and plan proactively. A carefully crafted tax strategy becomes a powerful asset for clients seeking to protect and grow their wealth.

3. Auditing and Assurance

On top of compliance, auditors now actively support clients’ financial health. By evaluating internal controls and verifying the accuracy of financial records, they help clients uphold strong financial practices. For firm owners, this shift calls for a proactive approach to auditing that prioritizes operational improvements and risk management, going well beyond basic regulatory standards.

4. Risk Management

Risk management has become more crucial in today’s complex landscape, with accountants playing a key role in identifying and mitigating compliance, operational, and financial risks. By cultivating a risk-aware culture in your firm, you empower your team to shield clients from unexpected challenges and address potential issues before they escalate.

5. Budgeting and Forecasting

Effective budgeting and forecasting equip businesses to plan and allocate resources wisely. Accountants skilled in these areas and those adept with accounting technology bring immense value, offering clients the financial foresight needed for confident, data-driven decisions.

6. Advisory Services

Sage research shows that 42% of clients look to their accountants for business advice, making advisory services a cornerstone of modern accounting. By offering guidance on growth strategies and risk management, accountants deliver high-level support that clients value. Expanding into advisory services opens new revenue streams for firm owners and strengthens your role as a trusted partner in clients’ vital financial decisions.

Maximize The Value of Your Team with TopFirm

Today’s accounting professionals don’t just manage numbers—they create value. Modern CPAs are advisors, analysts, and trusted guides who help clients navigate complex financial mazes. For firm owners, embracing this shift means unlocking the full potential of their team and positioning their practice as an indispensable partner.

At TopFirm, we design our coaching services to help you and your team fully embrace the evolving role of modern CPAs. From mastering cutting-edge accounting technology to expanding advisory skills and leadership abilities, we empower your firm to reach its full potential. If you need help transforming your practice, schedule a Free Growth Session with us today.

About the Author:

Alec Viray

Content Writer

Alec is a versatile content writer with years of experience in the accounting and financial services sector. His Psychology degree and strong content marketing, SEO, and blog writing background allow him to create engaging content that resonates with his target audience. Outside of work, Alec enjoys watching movies, TV shows, and anime and playing strategy-based RPG video games.