Adopting AI in Accounting: A Guide for Firms

Having worked in the accounting industry for over a decade, I can confidently say that Artificial Intelligence (AI) is no longer a futuristic concept, it’s already reshaping how accounting firms operate. What’s even more exciting is how AI continues to evolve, becoming an essential part of the industry’s future. By 2025 and beyond, AI is set to deliver transformative benefits that will drive the next wave of growth and innovation.

Yet, despite 69% of accountants believing AI will improve their tasks and responsibilities, a staggering 73% of accounting firms still aren’t using AI in 2024. The biggest hurdles? A limited understanding of AI and its potential benefits for their business. That’s why we created this guide—to provide clarity on how accounting firms can harness the power of AI.

What AI Brings to the Table

When accountants hear Artificial Intelligence in accounting the first idea that comes into their minds is automation and robots coming for their jobs. The truth is, AI is more than just automating tasks, and for the record: no, AI is nowhere near capable of replacing you. So, what exactly does AI have to offer?

Increased

Efficiency

AI empowers accounting firms by eliminating repetitive tasks, allowing accountants to focus on work that actually fires up their neurons. AI can handle mundane, repetitive tasks like data entry, reconciliation, and invoicing. This means less time spent on manual work and more time focusing on client relationships.

Enhanced

Accuracy

It boosts accuracy by minimizing human error. This helps improve the quality of work, but also helps maintain compliance and reduces risk for your clients.

Better Client

Insights

AI can process and analyze large volumes of data much faster than any human could. This leads to more informed decision-making and allows you to offer deeper insights and forecasts for your clients.

How Accounting Firms Typically Use AI

Now that you understand what AI can offer, let’s dive into how it can be implemented in your firm. The good news is that many AI-driven tools are already available and can be seamlessly integrated into existing workflows. Here are some of the most practical applications of AI in accounting:

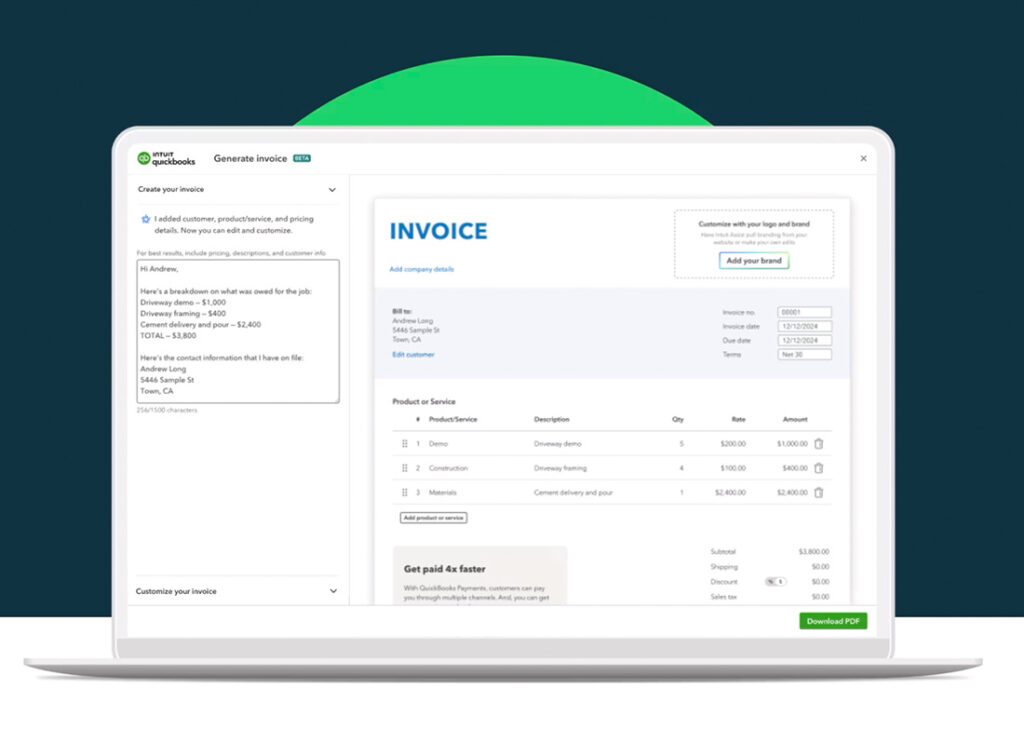

Automating Data Entry and Reconciliation

Accountants everywhere share a common frustration: manual data entry. AI in accounting software can automatically extract and classify data from invoices, receipts, and bank statements. Tools like QuickBooks and Xero have built-in AI that helps with bank reconciliation, suggesting matches, and categorizing transactions automatically.

This automation significantly reduces the time spent on data entry allowing your team to focus on higher value tasks, minimizing errors that can occur with manual input.

Predictive Analytics for Financial Forecasting

Predictive AI can analyze historical data and predict future trends. This is especially useful for financial forecasting and cash flow management. By identifying patterns, AI can provide forecasts that help clients make more informed business decisions.

For example, AI accounting can analyze spending patterns and predict cash flow issues before they arise. This proactive approach adds value to your clients and positions your firm as a forward-thinking advisor, rather than just a compliance provider.

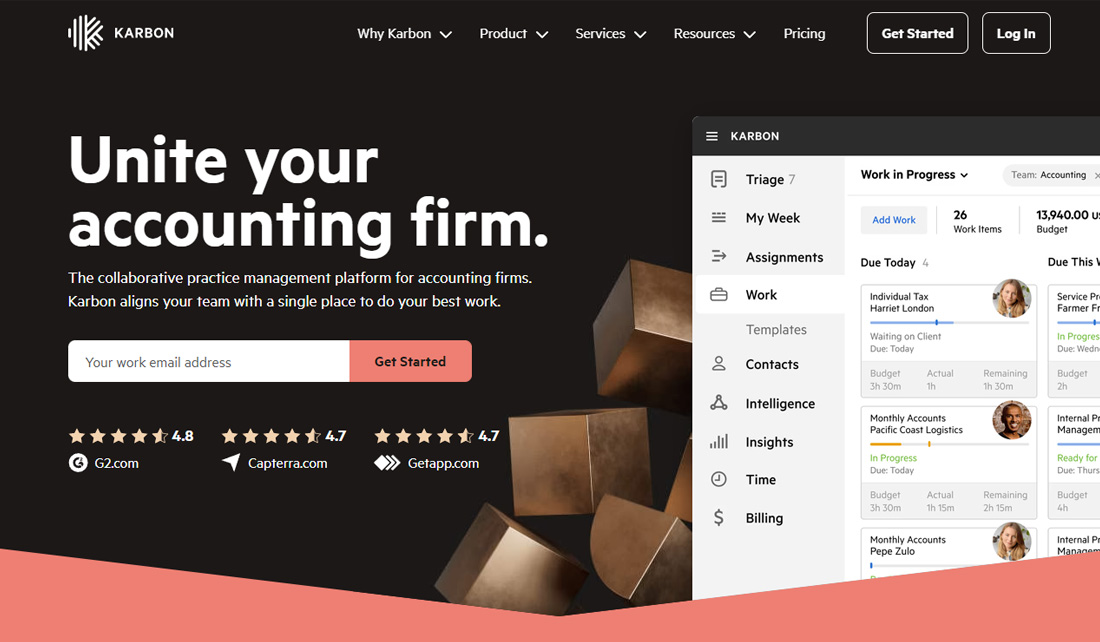

AI-Powered Communication

AI-powered communication tools, like chatbots and natural language processing (NLP) systems, are changing how you interact with clients and team members. For example, chatbots can handle routine client inquiries 24/7, providing quick answers about billing, deadlines, or just general information about services.

This helps reduce the workload on your staff while improving client satisfaction with faster, more responsive service. Moreover, AI can assist with client communication by generating draft emails or reports, summarizing lengthy documents, and even translating financial jargon into clear, digestible insights for your clients.

Internally, AI-powered accounting platforms such as Karbon can streamline collaboration across your firm. Whether scheduling meetings, organizing team projects, or creating task reminders, AI can handle the behind-the-scenes coordination, freeing up your team to focus on work that matters.

Fraud Detection

Fraud detection is a crucial area where AI is making a huge impact. Traditional fraud detection methods are often reactive, catching fraud only after it has occurred. AI, however, can proactively detect unusual patterns and flag potential fraud in real-time.

For instance, AI can monitor transactions for anomalies and alert you to suspicious activity, helping you take action before fraud becomes a major issue. This level of oversight would be impossible for a human team to manage at the same scale.

AI-Driven Audits

AI is revolutionizing the audit process by making it faster, more accurate, and more comprehensive. By analyzing large datasets, AI can identify discrepancies or anomalies that would also be impossible for humans to detect manually. This reduces the risks of error and helps auditors focus on areas that require more in-depth attention.

AI-driven audit tools can scan through years’ worth of transactions in a fraction of the time it would take an auditor. It can also provide insights that help auditors ask better questions and make more informed judgments.

AI-Assisted Tax Preparation

Tax season is stressful for everyone, but AI is making it easier. AI-powered tax preparation tools can automatically review client data, identify applicable deductions, and flag potential issues. This reduces the time spent on tax prep and ensures compliance with constantly changing tax laws.

For firms that manage multiple clients during tax season, AI can provide real-time updates on tax law changes and apply those changes across all relevant returns. This ensures that clients are always up-to-date and compliant, reducing the risk of costly penalties.

How to Introduce AI Into Your Accounting Firm

The idea of integrating AI into your firm might seem daunting, but it doesn’t have to be. Here’s a step-by-step guide to help you get started:

1. Assess Your Needs

Not every AI tool will be a good fit for your firm. Start by assessing where AI can add the most value. Are you struggling during tax season? Is your team spending too much time inputting manual data? Identify the areas where AI can have the biggest impact.

2. Choose the Right Tools

There’s already a plethora of AI tools for accounting, and it can be overwhelming to pick which will fit your firm the best. Do your research and choose the tools that align with your firm’s needs and budget.

3. Assign Ownership for AI Implementation

Successful AI implementation requires a dedicated person or small team to take ownership of the process. You can’t simply introduce AI and hope for the best—someone must oversee its integration and ensure it’s used to its full potential. Many firms stumble by spreading AI adoption responsibilities across the organization, leading to confusion and stagnation.

4. Invest in Learning and Upskilling

Once the right person or team takes ownership of AI implementation, the next step is proper training. However, many accounting firms hesitate at this stage, as learning modern AI tools and training the entire staff can be time-consuming.

The good news is you don’t have to tackle it alone. You can bring in an external coach to upskill your team or invest in online courses to ensure everyone is up to speed.

5. Start with a Pilot Program

Before rolling out AI firm-wide, start implementing AI in one area, like data entry or bank reconciliation, and gradually expand from there. This allows you to see how the tech performs in real-world conditions without disrupting your entire organization.

A pilot program also gives your team time to adjust and get comfortable with the new technology. As they become familiar with AI tools, they’ll likely discover more ways it can improve the firm’s workflows, leading to a smoother full-scale implementation down the line.

6. Monitor and Optimize

AI tools can continuously learn and improve over time. Monitor their performance, gather feedback from your team, and look for ways to optimize the tools for better results.

The Accountant-AI Partnership

As AI becomes more prevalent in accounting, some accountants worry about job security. In reality, the human element is irreplaceable. AI should be seen as a powerful tool to enhance client services, not as a threat.

Sure, AI can handle the data and automate the grunt work, but it’s on you, as accountants, to take that information and turn it into meaningful advice for clients. AI can’t translate complex financial insights into actionable strategies and that’s where you step in. You’re the trusted advisor who can explain what the data means, and how it impacts your client’s business, and guide them on the next steps.

Ultimately, clients want more than just numbers or automated reports. They need someone who understands their goals, and challenges, and can offer practical advice. AI might speed things up, but it can’t replace the human connection. An accountant’s ability to build relationships is what truly sets them apart in an AI-driven world.

Recap

AI is transforming how accounting firms deliver value to their clients, reshaping the profession in ways we couldn’t have imagined ten years ago. As a firm owner, adopting AI is essential to staying competitive and ensuring you provide the highest level of service to your clients.

By tapping into the power of AI, your team gets to focus on what matters: building strong relationships with your clients and helping them achieve their financial goals. If you’re among the 73% of accounting firms who haven’t started their AI journey yet, now’s the time.

About the Author:

Nick Sinclair

Founder – TopFirm

Nick Sinclair is a visionary leader in the accounting industry, dedicated to helping CPA firm owners unlock their true potential. With 20+ years of experience, Nick has built an impressive career as an entrepreneur, coach, and former owner of an accounting and financial planning firm. He has founded transformative companies like TOA Global, Ab² Institute of Accounting, and TopFirm, collectively empowering more than 1,100 firms worldwide.