Mastering Accounting Workflow: Setting Your Firm for Success

When we talk about accounting workflows, we’re talking about the very structure that keeps your firm running smoothly. Over the years, I’ve learned that accounting firms must have robust workflows to achieve growth. Now, you might think a workflow is just a to-do list for accountants that needs to be checked off, but it’s a lot more than that.

An efficient workflow is about creating a system that enhances productivity, reduces stress, and delivers top-shelf value to clients. The accounting industry is highly process-driven, and without proper cogs set up, firms become tangled in inefficiency, resulting in missed deadlines and dissatisfied clients.

In this guide, we’ll talk about the essentials of optimizing accounting workflows. Whether you’re defining your firm’s processes for the first time or enhancing existing ones, there’s plenty to explore, so let’s get started.

Why Workflows Matter in Accounting

From my experience, one of the first lessons firm owners learn is that growth brings complexity. As your firm scales, so do the number of clients, regulations, and tasks you juggle. When there’s no clear structure, tasks quickly pile up, leaving your team overwhelmed. What’s worse, errors creep in—client documents get lost, deadlines are missed, and soon enough, your firm’s reputation is on the line.

A well-defined accounting and finance workflow eliminates these issues by standardizing how tasks are carried out. It gives your team a clear roadmap to follow, ensures consistent output, and provides transparency into where each job stands at any point in time.

More importantly, efficient accounting workflow processes help you deliver quality services with fewer resources. This is key for accounting firm leaders looking to scale without sacrificing client satisfaction.

I’ve worked with firms that thought they were handling things well until they realized they were operating in chaos. There was no clear delineation of responsibilities, meaning everyone was doing everything, yet nothing was being done effectively. That’s when we brought in proper workflow management, and things started to turn around.

Building an Effective Accounting Firm Workflow

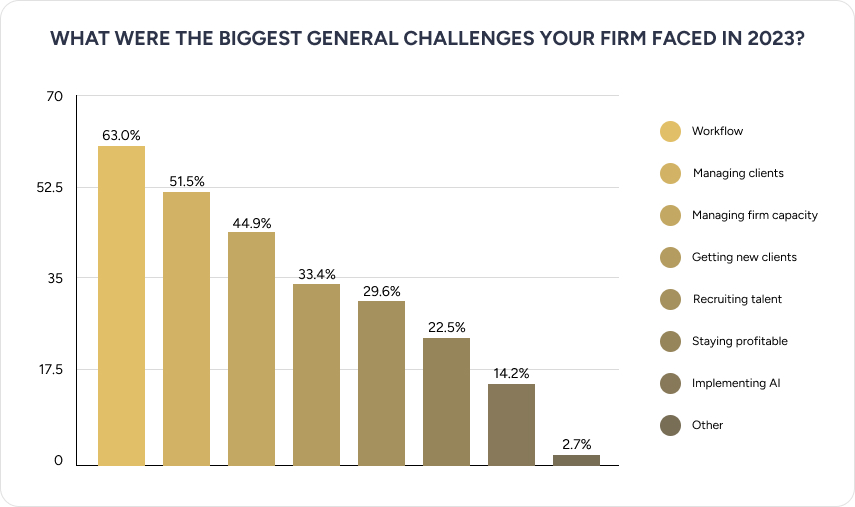

A 2023 report by Financial Cents revealed that 63% of firms identified workflow as their biggest challenge.

Even more surprising, in 2022, 66.7% of respondents cited workflow as a major issue for their firms, showing little improvement over the year. So, how do you create a workflow that actually works?

The truth is that creating an efficient workflow isn’t a one-size-fits-all approach. What works for one firm might not work for another. However, there are several fundamental steps that all firms should follow when establishing their workflows

1. Identify and Document Key Processes

The first step in any workflow is to identify the processes within your firm. Break down each service you offer—tax preparation, auditing, or payroll—into individual steps. If your practice is already successful, you likely have a process in place, but it may not be fully documented. Take the time to map it out from beginning to end.

Once you’ve documented your processes, you’ll see where bottlenecks occur. These could be points where approvals take too long or where there’s redundancy in task handoff between team members. Identifying these traffic areas is critical for optimization.

2. Delegate Responsibility

One of the biggest issues I’ve seen is when “everyone’s responsible, but no one’s accountable.” To prevent this, assign each step of the process to a specific person or team. When ownership is clear, tasks don’t slip through the cracks, and everyone knows exactly who to go to if problems arise.

3. Invest in the Right Tools

You can’t discuss workflows in 2024 without bringing up technology. The tools you use to manage workflows will either enhance or hinder their effectiveness. Fortunately, there is a wide range of accounting workflow software built to streamline your processes. A few examples include:

The right tool should integrate smoothly with your firm’s accounting software and provide clear visibility into project statuses. This transparency is essential for maintaining progress and ensuring you meet client deadlines.

4. Automate Where You Can

We’re now in that era where the term “automation” has become a daily part of an accountant’s work life. Automating routine tasks like invoice generation, reconciliation, and report preparation allows your team to focus on higher-value tasks that truly require their expertise. Accounting workflow automation reduces human error, speeds up workflows, and frees time for more meaningful work. In my experience, firms that embrace automation see marked improvements in efficiency and profitability.

5. Prioritize Client Experience

While internal efficiency is crucial, it’s just as important to prioritize your client’s experience. Your workflows should keep clients informed and ensure their questions are answered quickly.

Tools that automate reminders for document submissions or provide real-time project updates can significantly improve the client experience. Transparent and timely communication builds trust and strengthens client relationships.

Pinpointing Workflow Bottlenecks

Even the most efficient highways can get congested sometimes. It’s the same for your workflow. These are often hidden until you start scrutinizing your process. Some common bottlenecks include:

- Approval Delays – One of the biggest time sinks is waiting for approvals, especially if they require busy senior management’s attention. In many cases, approvals can be streamlined by delegating decision-making power to managers or partners for routine tasks.

- Manual Data Entry – Even with advanced technology at their disposal, many firms still rely on manual data entry for tasks like tax returns and payroll. This not only increases the risk of errors but also wastes valuable time. Automating these processes can remove this inefficiency.

- Task Handoff Issues – Tasks frequently pass between team members in complex workflows. Without a clear system for these handoffs, you invite delays, confusion, and mistakes. Implementing CPA workflow software that tracks real-time handoffs can prevent these issues and keep everything on track.

Optimizing Your Workflow

Is your workflow set and working? Congratulations! Just remember that the job’s not done. Continuous improvement should be the goal. Regularly review your processes to find areas for improvement. Ask your team for feedback—they’re the ones in the trenches and will have valuable insights into what’s working and what’s not.

Start by tracking key performance metrics, such as time to complete tasks, client satisfaction levels, and error rates. Use this data to identify inefficiencies and adjust when needed. For example, if you notice that certain tasks consistently miss deadlines, it might be time to redistribute workloads or refine that process step.

Finally, don’t hesitate to bring external help. Whether it’s hiring consultants to audit your workflow or attending industry workshops on workflow optimization, there’s always something new to learn. Many of the firms I’ve worked with have benefited greatly from outside perspectives.

Accounting Workflow Examples

Here are a few typical workflow examples that firms might use.

Client Onboarding

“I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.”

– Maya Angelou

The client onboarding process is the first touchpoint with new clients, and it’s paramount to get it right. To avoid unnecessary back-and-forth, implement a well-defined client onboarding workflow that guarantees a smooth transition for every new client.

A streamlined onboarding workflow should include setting up client profiles, gathering essential financial documents, signing engagement letters, and establishing communication protocols. A well-organized onboarding process builds trust from the get-go and reduces the chance of miscommunication.

This workflow can be optimized by using automation tools to gather documents, send reminders, and set up client accounts seamlessly in accounting software. Firms that standardize this process save time and ensure every client gets a consistent onboarding experience.

Accounts Payable/Receivable Workflow

Every accounting firm needs efficient workflows for managing accounts payable (AP) and accounts receivable (AR). The AP workflow ensures that vendor bills are processed on time, approvals are gathered, and payments are issued immediately. On the AR side, this workflow guarantees that invoices are sent, payments are tracked, and follow-ups are conducted when necessary.

Automating key steps like invoice generation and payment reminders reduces manual errors and improves cash flow management for firms. Many firms use tools that integrate directly with their accounting systems to handle these workflows more efficiently.

Tax Preparation Workflow

Tax season can quickly overwhelm a firm without a strong workflow in place for tax preparation. This workflow should encompass document collection, review processes, and filing. The goal is to gather all relevant client tax documents, ensure accurate data, and timely file returns.

Firms often use accounting workflow management tools to assign tasks, track progress, and meet deadlines. Automation also helps streamline document collection and verification so teams can focus on reviewing and analyzing the returns instead of chasing down paperwork.

Financial Reporting Workflow

Accurate and timely financial reporting is a core deliverable for accounting firms. This workflow includes gathering transaction data, reconciling accounts, adjusting entries, and generating financial statements such as P&L or balance sheets.

Again, you can streamline the process by using accounting software to automate data extraction and report generation. Workflow tools help assign team members to review stages, track approvals, and ensure the timely delivery of reports to clients.

Payroll Management Workflow

Payroll is another essential workflow that every firm should have in place. This process involves collecting employee data, calculating wages, taxes, and deductions, and distributing payments. With the added complexity of tax filings and compliance, payroll workflows benefit significantly from automation.

Most firms use software like QuickBooks Payroll to handle all payroll management needs. Automating the payroll can reduce errors, speed up processing times, and ensure that staff are paid correctly and on time.

Run a Well-Oiled Accounting Firm with TopFirm

Having a well-structured accounting workflow is more than just making life easier for your firm; it’s also about building a foundation for long-term growth and success. When you streamline these processes, your firm becomes more agile, scalable, and capable of delivering top-quality service to your clients.

Remember that defining your accounting firm’s workflow is just the beginning. Real growth comes when you fine-tune those workflows to align with your team and technology. At TopFirm, our coaching services help accounting firm owners like you refine and scale operations.

We offer the strategies and guidance you need to build a thriving firm that meets today’s demands and is ready for tomorrow’s challenges. Schedule your free Growth Session today, and let’s explore working together.

About the Author:

Nick Sinclair

Founder – TopFirm

Nick Sinclair is a visionary leader in the accounting industry, dedicated to helping CPA firm owners unlock their true potential. With 20+ years of experience, Nick has built an impressive career as an entrepreneur, coach, and former owner of an accounting and financial planning firm. He has founded transformative companies like TOA Global, Ab² Institute of Accounting, and TopFirm, collectively empowering more than 1,100 firms worldwide.