13 Actionable Accounting Lead Generation Strategies for CPA Firms

As a CPA coach working with accounting firm owners, I’ve noticed a common thread in our conversations: “How can I get more leads?” Lead generation for accountants presents unique challenges. Accounting firms need more than quick opt-ins or a list of random email addresses. The focus should be on consistently attracting qualified leads—businesses that need your services and are ready to invest in your expertise.

So, in this blog, I want to share proven and innovative lead gen techniques designed specifically for CPA firms.

1. Identify Your Niche

The accounting industry is vast, and trying to appeal to everyone often leads to attracting no one. When it comes to accounting lead generation, clarity is power. The more specific you are about your niche, the better you can tailor your marketing efforts.

Whether it’s working with e-commerce businesses, construction companies, or startups, knowing your niche helps you speak the language of your ideal clients.

Put yourself in the shoes of your target audience: If you’re a tech startup founder looking for a CPA to help with your finances, who would you trust more, someone who claims to “work with all businesses” or someone who “specializes in managing finances for SaaS companies”? The latter wins every time.

Actionable Tip:

Take the time to define and refine your niche. Once you’ve identified it, ensure your website, social media profiles, and content reflect that. Write blog posts that address the specific challenges your niche faces. Host webinars and workshops targeted at that group. The more tailored your message, the more leads you’ll attract.

2. Leverage Client Testimonials and Case Studies

Word of mouth has always been a powerful marketing tool in the accounting industry. But in today’s digital age, you need more than verbal recommendations, you need proof that you deliver results. That’s where client testimonials and case studies become crucial.

Case studies show potential clients how you’ve helped businesses just like theirs. Whether it’s saving a client thousands in taxes or improving their financial reporting processes, these real-life examples make a huge impact. Client testimonials, on the other hand, provide social proof, reassuring prospects that you’re good at what you do.

Actionable Tip:

Reach out to satisfied clients and ask for their feedback. Turn their experiences into compelling case studies and testimonials you can showcase on your website, social media, and email campaigns. A well-placed success story can often be the deciding factor for a potential lead.

3. Optimize Your Website for Lead Generation

Your website is often the first point of contact for potential clients, so you must ensure that it’s optimized to convert visitors into accounting leads. I’ve seen too many accounting firm websites packed with information but lack clear calls to action (CTAs).

Example of a well-optimized website from a TopFirm client: Tax Samaritan

Think of your website as a sales funnel. Every page should guide visitors toward taking the next step—whether that’s signing up for a newsletter, booking a consultation, or downloading a resource. Lead magnets such as eBooks, checklists, or free consultations are highly effective for capturing and nurturing leads over time.

Actionable Tip:

Review your website’s layout and content. Is it easy for your visitors to find what they need? Do you have clear CTAs?

Consider offering a free downloadable resource that addresses a pain point for your target audience. For example, a resource about the “Year-End Tax Checklist” as Q4 rolls out can position you as an expert while capturing email addresses for future follow-ups.

4. Email Marketing

Making $36 for every $1 spent is a massive ROI, and if you’re not utilizing email marketing in 2024 as one of your main lead generation tools, you’re leaving bags of money on the table. Email marketing is especially effective in the accounting world where trust and relationships are essential.

When done right, email marketing nurtures leads over time, helping you stay top of mind when a business finally decides to choose or switch CPAs.

Remember, these people have trusted you with their email, so avoid overwhelming them with sales pitches. Instead, focus on delivering value. Send regular newsletters that offer insights, important updates, or financial management tips. Keep your audience informed, educated, and engaged.

Actionable Tip:

Build an email list and segment it by industry, company size, or service needs. That way, you can send targeted content that resonates with each group. Use automation to follow up with leads who’ve downloaded resources or attended webinars. The more personalized your emails, the more effective they’ll be in converting prospects into clients.

5. Host Webinars and Virtual Events

Speaking of webinars, we’re living in a world where in-person events aren’t always feasible, but that doesn’t mean you can’t still connect with potential accounting leads face-to-face. Webinars and virtual events offer an excellent way to showcase your expertise, engage with prospects, and nurture relationships.

Think of it as giving away a taste of what it’s like to work with you. When you host a webinar on a topic like “Tax Planning Strategies for Small Businesses” or “How to Maximize Profitability in Uncertain Times,” you’re offering value upfront. Attendees are more likely to see you as a trusted advisor, and when they’re ready to hire, your firm will be at the top of the list.

Actionable Tip:

Pick a topic that speaks to your ideal client’s pain points. Promote your event through email campaigns, socials, and your website. After the event, follow up with the attendees with a “thank you” email along with a summary of the key points.

Additionally, you can send a “sorry you couldn’t make it” email to the no-shows along with the same summary of the key points. Make sure to include a call to action in both emails, whether that’s booking a consultation or offering a recorded version of the webinar.

They will appreciate your efforts in sending the highlights, and you get a better chance to convert them into leads.

6. Social Media Marketing

Social media isn’t just for influencers and consumer brands. It’s a powerful tool for CPA firms to build relationships, showcase expertise, and yes, generate leads. But here’s the thing: success on social media isn’t just about chasing vanity metrics such as likes or followers, it’s about engaging with the right audience and positioning yourself as a trusted advisor.

Each platform has its strengths, so it’s important to focus on the ones where your target audience is most active. For most accounting firms, that’s LinkedIn, but don’t discount platforms like X, Facebook, or even Instagram and TikTok, depending on your niche.

The key is to be omnipresent on all relevant platforms, be consistent, and provide value.

Actionable Tip:

Take the time to define and refine your niche. Once you’ve identified it, ensure your website, social media profiles, and content reflect that. Write blog posts that address the specific challenges your niche faces. Host webinars and workshops targeted at that group. The more tailored your message, the more leads you’ll attract.

Make sure your headline is clear and compelling and use your summary to tell your story—what sets you and your firm apart from other CPAs or competitor firms. Post valuable content regularly, and don’t hesitate to reach out to your network to build relationships that could turn into leads down the road.

An extra pro tip if you’re struggling to post consistently on social media is to repurpose existing content such as blogs, whitepapers, reports, etc. Chop up informative highlights into bite-sized social media posts.

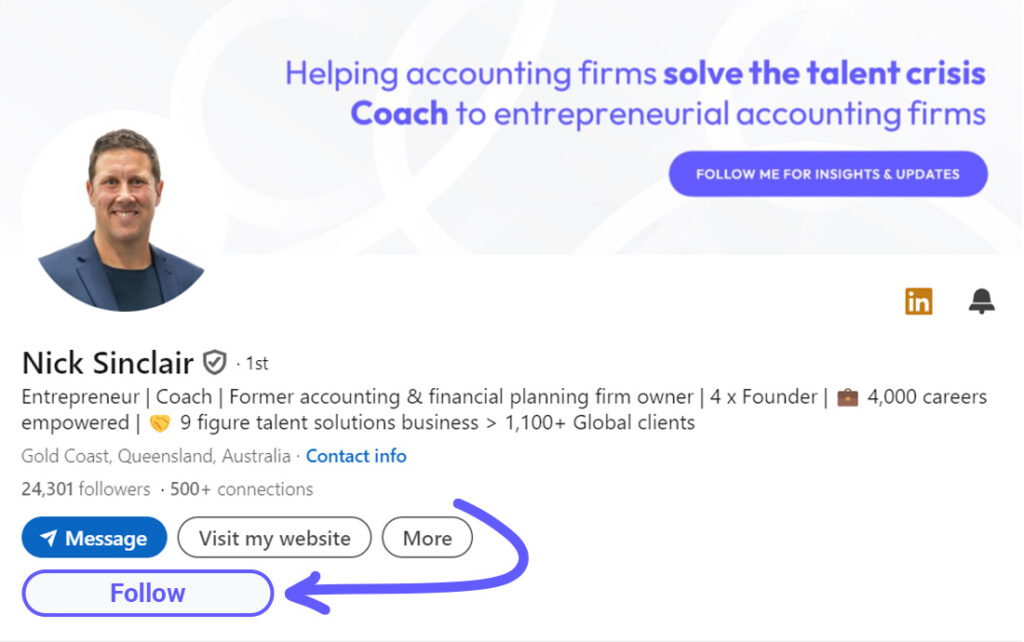

If you’re looking at how to get started with socials, you can follow me on LinkedIn and see what I do.

7. Implement a Referral Program

I’ve talked to a lot of accounting firm owners who still have referrals as the lifeblood of their firms and for good reasons. Leads that come through referrals are often high-quality and ready to buy. But don’t just sit back and wait for referrals to happen.

Actively encourage your clients to refer you to others by implementing a formal referral program. This could be as simple as offering a discount on services or a small gift as a thank you. The key is to make it easy for clients to refer you and to reward them when they do.

Actionable Tip:

Develop a referral program that incentivizes both clients and referral partners, such as other professionals in complementary industries (e.g., lawyers, and financial advisors). Promote the program on your website, in your emails, and during client meetings.

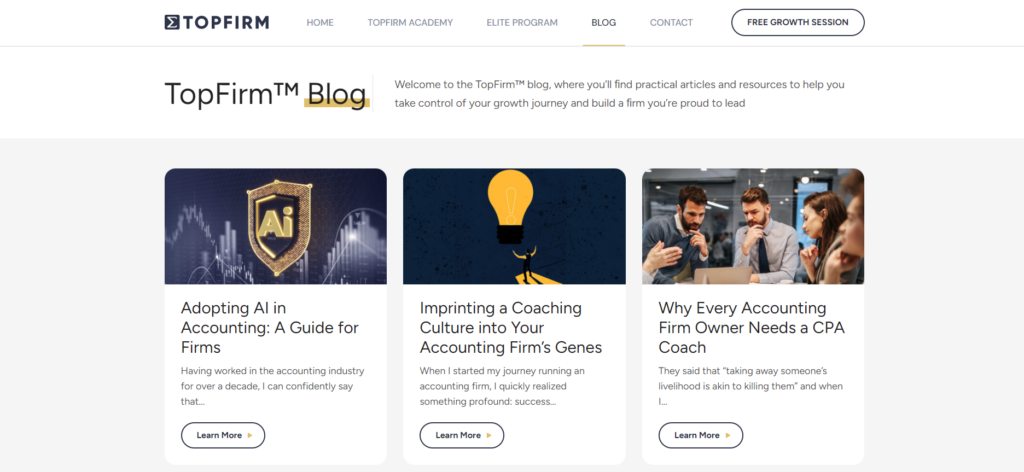

8. Content Marketing: Become a Thought Leader

When it comes to lead generation, content is where the money is at. The more helpful and informative content you produce, the more likely prospects will find you when they search for solutions to their accounting problems.

Blog posts, webinars, podcasts, and eBooks allow you to showcase your firm’s knowledge and provide value before a prospect even reaches out to you. Content marketing is an amazing way to establish trust. The more trust you build, the more leads you’ll attract.

Actionable Tip:

Start a keyword research, then create a content calendar and consistently produce content that speaks to the challenges your niche faces.

Share success stories, break down complex accounting topics, and offer actionable advice. Over time, this will position you as an authority in your field, bringing in a steady stream of leads.

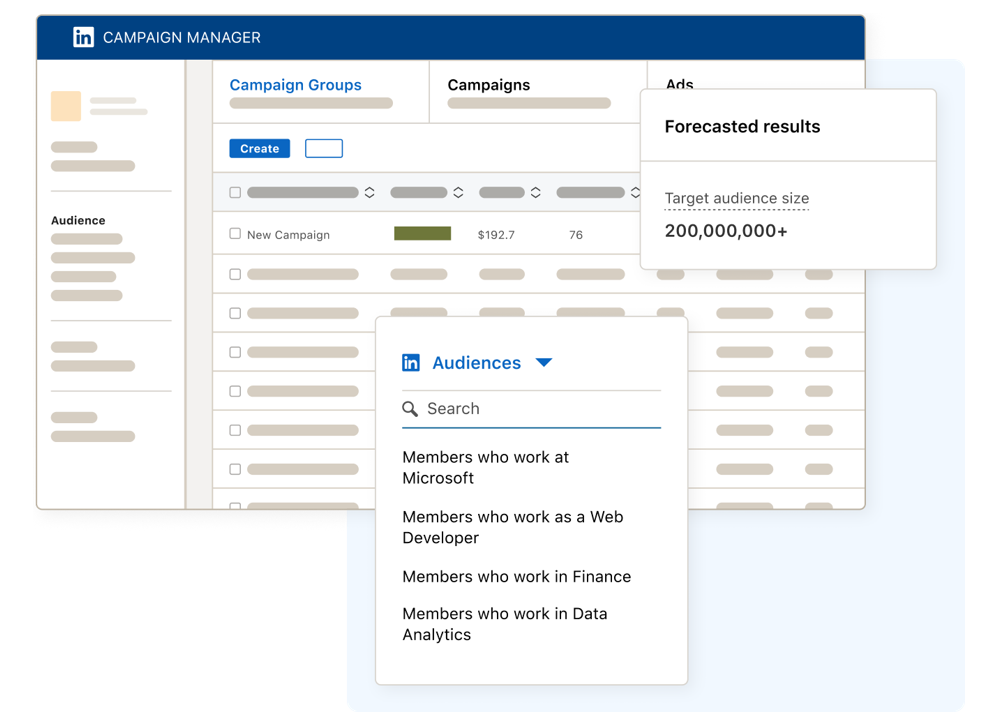

9. Paid Advertising

While organic lead generation methods are essential, sometimes it helps to put some money behind your efforts. Paid advertising on platforms like Google Ads, LinkedIn Ads, or even Meta Ads, can give you the visibility you need to attract high-quality CPA leads faster. The secret sauce lies in targeting.

In accounting, you don’t need to reach everyone, just the right people. Paid ads let you get hyper-specific, targeting business owners by industry, demographics, or even job title. This ensures your ads are being shown to potential clients who actually need your services.

Actionable Tip:

Study up on the proper use of paid advertising. Experiment with platforms like Google Ads but be cautious when it comes to spending. It’s easy for costs to spiral if campaigns aren’t properly managed.

Without the right targeting and strategy, it can quickly turn into a money sink. Make sure you know what you’re doing before committing to a budget. If you don’t have much experience, consider hiring a specialist who understands the nuances of Google or LinkedIn Ads and can optimize your campaigns for maximum ROI. A well-executed ad strategy can be a game-changer, but only if done right.

10. Be Where Your Clients Are

Being omnipresent means going where your clients are hanging out and sometimes that goes beyond social media. In addition to LinkedIn and Facebook groups, that’s often in online communities and industry-specific forums such as Reddit’s Subreddits, Quora, etc. These spaces are full of business owners looking for advice, guidance, and yes, the services you offer.

By actively participating in these communities, you can position yourself as a go-to expert when someone asks for recommendations on accounting services. The key is not to be overly promotional. Instead, offer value upfront. That means answering questions, sharing insights, and building relationships.

Actionable Tip:

Join online communities relevant to your niche. For example, if you specialize in serving real estate businesses, look for forums or online groups where realtors hang out and answer their accounting questions. You can also go to platforms like Quora where people ask specific accounting questions.

11. Use Local SEO

Many accounting firms overlook local SEO, yet it’s a powerful tool for generating leads from nearby businesses. When potential clients search for ‘CPA near me’ or ‘accounting services in [your city],’ your firm should appear at the top of the results.

A well-optimized Google Business Profile is key. By keeping your firm’s profile complete with accurate contact details, hours, and services, you increase your chances of appearing in local search results. Regularly posting, collecting reviews, and keeping the profile active will further boost your ranking.

Learn More About SEO

SEO for Accounting Firms: A Guide for Busy Firm Owners

Actionable Tip:

Set up and optimize your Google Business Profile, including key details like your services, photos of your office, and client testimonials. Ensure that your website is optimized for local SEO by including location-based keywords like “[City] CPA firm” throughout your site.

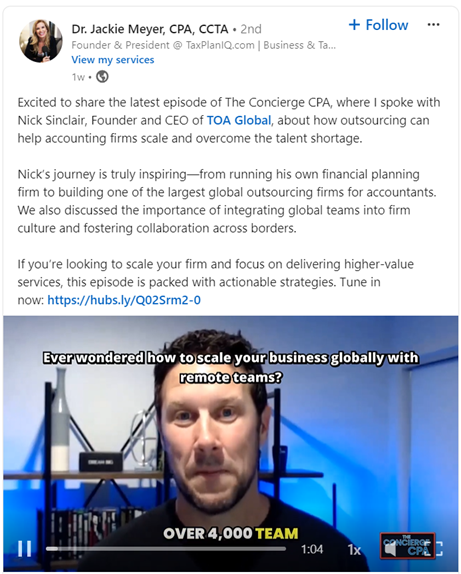

12. Appear on Podcasts

Podcasts have exploded in popularity, and they offer a unique opportunity for CPAs to reach potential clients in a more engaging, personal way. By joining industry-related podcasts as a guest, you can showcase your expertise to new audiences while building credibility.

Think about it, you’re not just offering advice in a dry, one-dimensional format. You’re having real conversations, sharing stories, and demonstrating your value as a trusted expert.

The best part? The podcast host will promote the episode for you, and you get access to their fanbase. Moreover, these podcast episodes live long after the recording—this episode for one happened before I stepped down as the CEO of TOA Global—but it will continue generating leads for months or even years.

Actionable Tip:

Research podcasts that cater to your target audience—whether it’s business owners, entrepreneurs, or specific industries like dental or healthcare. Reach out to the host and pitch a topic that you can speak on with authority.

13. Collaborate with Complementary Businesses and Non-Competing Firms

Collaboration is a powerful lead generation tool, especially when you partner with businesses that share your client base but offer different services. Consider teaming up with financial advisors, business consultants, CPA firms with different specialties, or even firms in other service areas.

By partnering with these non-competing firms, you can create mutually beneficial relationships where you refer clients to each other. It’s a win-win: your clients get access to the services they need, and you generate more leads without additional marketing expenses.

Actionable Tip:

Identify potential partners who serve the same target market. Reach out to explore collaboration opportunities, such as hosting joint webinars, cross-promoting content, or creating a referral network. You can also join peer groups such as TopFirm’s Peer-Led Support and Community to connect with other non-competing accounting firm owners and trade referrals with each other.

Grow Your Accounting Firm with TopFirm

The effectiveness of each lead generation tactic may vary but by applying these tactics, you can create a lead pipeline that works for your firm. As you build relationships, demonstrate your expertise, and provide value to your niche, you’ll start to see more high-quality accounting leads coming your way.

The accounting industry is competitive, but there’s no shortage of opportunities for firms that take a strategic approach. If you’re looking for a risk-free approach to growing your firm, consider TopFirm’s coaching program.

Our world-class coaches, proven playbooks, and peer community will give you all the tools and support that you need to grow your firm. Secure a slot on our calendar and book your Free Growth Session today.

About the Author:

Nick Sinclair

Founder – TopFirm

Nick Sinclair is a visionary leader in the accounting industry, dedicated to helping CPA firm owners unlock their true potential. With 20+ years of experience, Nick has built an impressive career as an entrepreneur, coach, and former owner of an accounting and financial planning firm. He has founded transformative companies like TOA Global, Ab² Institute of Accounting, and TopFirm, collectively empowering more than 1,100 firms worldwide.